I’m From the Future, and Your Financial Forecast is Wrong

When done well, a good financial forecast allows the business to make the right investments at the right time and allows finance to set more accurate expectations with investors. Unfortunately, many financial forecasts do not consider enough variables, consider the market perspective, or have a flexible yet robust process. The future norm for financial forecasting will be a combination of subjective veteran business leader input and advanced financial modeling that coalesce human experience and computational knowledge in a meaningful way.

Driving Your Forecast

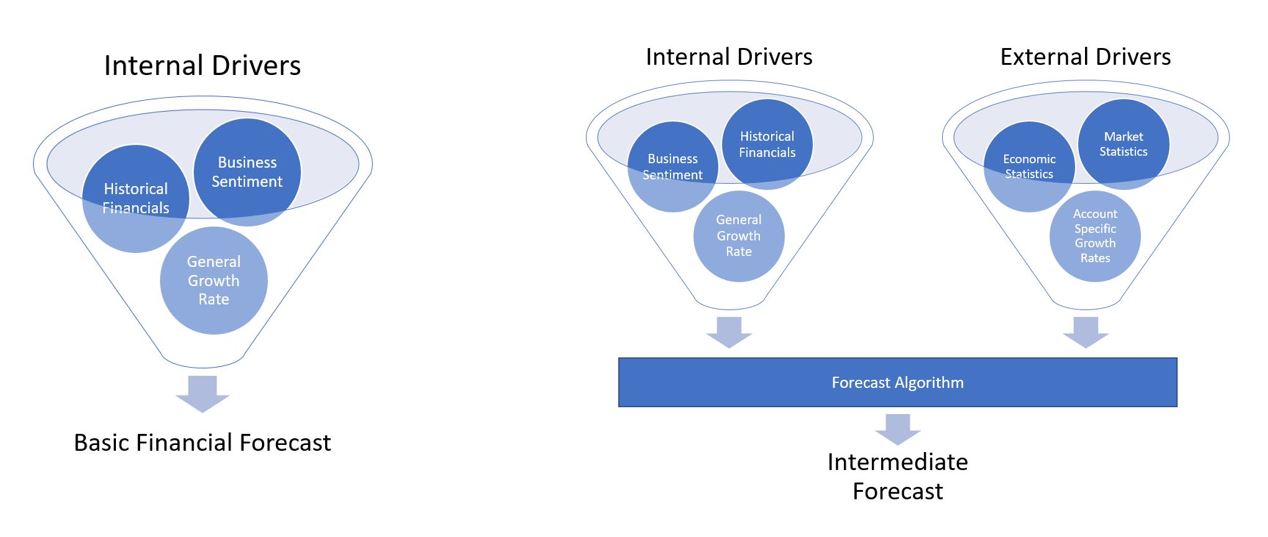

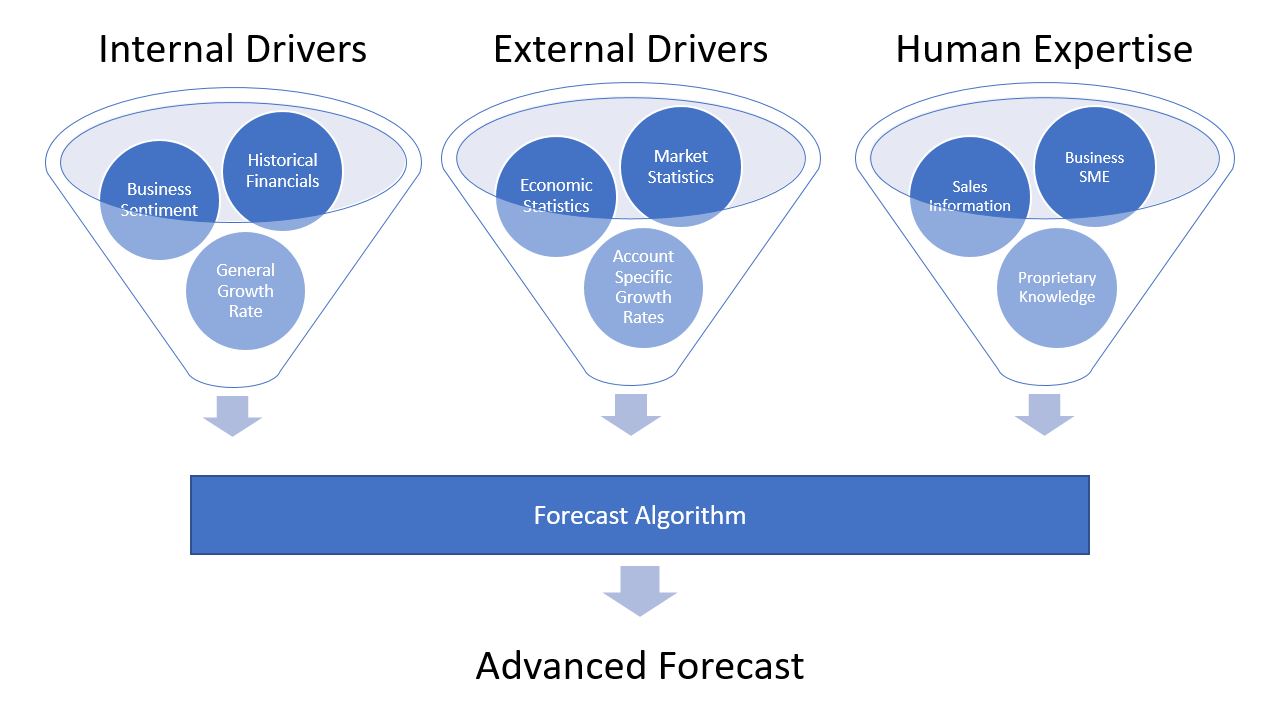

Financial forecasts often do not consider enough variables or test the significance of their existing driver set. Typically, a basic set of internal drivers, and possibly a small set of external drivers, will be considered when casting a forecast. These drivers include things like an estimated market growth rate or the result of a sales quota update. These drivers may indeed create an accurate forecast, but their statistical significance is rarely ascertained. In order to accurately predict revenue for a volatile product line with an appreciable level of precision, finance teams need to consider more exogenous variables such as consumer confidence, consumer debt levels, inflation, GDP growth, political policy changes, and other broad economic data. The process doesn’t end there, though. The significance of each driver needs to be understood, both for modeling purposes and for the business to understand what factors drive its performance.

The data being considered needs context, and a good revenue model should incorporate economic context. For example, revenue will often be correlated with GDP growth and consumer confidence, but that relationship may not be smooth or linear in nature. Markets often have products that are considered substitutes (apples and oranges), inferior goods (canned apples), luxury competitors (organic apples), and direct competitors (other orchards). As consumer well-being changes over the course of the business cycle, lumpy groups of customers will either gain access to a luxury alternative, a substitute or an inferior good when times are bad. There are many other great examples of this economic context (market consolidation, price elasticity, or compliments, to name a few), and your organization and model should consider these concepts when making your predictions.

Human Expertise

Keeping a human touch makes models even better. Models are good at predicting future results off a set of drivers. However, any potential new driver might not have a historical precedent. For example, a model will often struggle to accurately predict revenue in a year when a new product launches. This is where it is important to have a well-trained human in the forecasting process. Humans can “put their finger on the scale” and change the overall estimate to incorporate these unprecedented events. Models also augment a human’s judgement. Assuming the human involved in changing the forecast has an advanced analytics background, they will be able to use alternative models to assist with their ad-hoc prediction. These models will help any human reduce their exposure to bias and heuristics, and instead, they’ll be able to deliver an accurate alteration to the forecast.

A robust forecast will always have the right data, context, process, and skills on hand. Getting your financial forecast in order should be a priority for any finance team. Luckily, according to my forecast, you’ll be there in no time.

About Ironside

Ironside was founded in 1999 as an enterprise data and analytics solution provider and system integrator. Our clients hire us to acquire, enrich and measure their data so they can make smarter, better decisions about their business. No matter your industry or specific business challenges, Ironside has the experience, perspective and agility to help transform your analytic environment.