Preparing for an Incentive Compensation Audit

For many, the word “audit” brings a range of negative emotions such as fear, anxiety, and uncertainty. But does it need to be that way? After all, an audit is essentially a diagnostic or check of the business processes and results that exist in a company. Hence, it should be viewed as essential to business success.

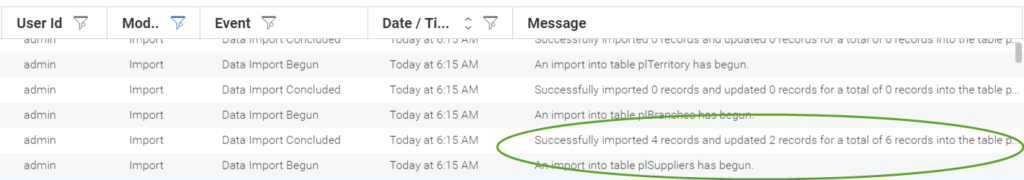

Before we joined Ironside’s consulting ranks, we went through multiple audits as compensation administrators and found that preparation and good software were essential to our success. Both the preparation and software are vital to providing auditors with what they love to see — namely, a record of activity. In the example shown below, the software being used provides key details of what changed in updated records.

How many businesses are proactively preparing for such internal checks of the Incentive Compensation systems and process? We will explore the best ways to help you prepare for an audit.

Why is an Incentive Compensation (IC) Audit So Important?

Consider these three perspectives:

- From a financial perspective, you don’t want to pay too much to your salesforce in terms of what’s reasonable and fair for their performance. An objective and unbiased IC audit helps you make these types of compensation decisions. Variable Compensation is likely a material amount for reporting and audit purposes.

- From a compensation administrator’s viewpoint, an audit is a check on their work, and illuminates whether it is done effectively and accurately. Are there any holes that could lead to potential losses? Are there ways to improve processes? In preparing, you can show the company that you are a top performer!

- From a payee’s vantage point, a successful audit fosters trust and transparency of the Incentive Compensation system and its administration.

In our experience, an audit may occur every one to three years. Preparing for the audit is a process that involves three key activities: the Checklist process, the Business Process Documentation, and Analytics. When the organization invests time executing on these three activities, they arm themselves with pertinent information that better prepares them for facing the Incentive Compensation audit. We will briefly explore the three activities in the process.

The Checklist Process: What Is It?

A checklist is a comprehensive list of important or relevant actions, or steps to be taken in a specific order. There can be different forms and levels of checklists employed by the compensation administrators and managers to ensure smooth and accurate payment of commissions. A few examples of checklists are listed below:

- Checklist of periodic processes

- Checklist for key controls to the commission process — e.g., numeric count of payees in payroll report vs. monthly report, checklist of payees with zero earnings for verification, etc.

- Change management process: approvals, development, and testing

The Essentials of Documentation

Documentation is the process of collecting, abstracting, and coding printed or written information for future reference. There are two main types of documentation: documentation that specifies what to do (process documents), and documentation that verifies what was done (such as reconciliations or variance analysis). A great way to impress an auditor is having the appropriate documentation of the IC processes and proof of periodic activities completed properly. Auditors like to see that the business processes are protected from unforeseen events, and that structured documentation is in place to ensure business process continuity.

The Role of Analytics

Providing analytics on performance and actual payouts serves two immediate goals. It provides information to sales leaders to help them achieve their strategic goals, and it verifies completeness of compensation. Both may be of interest in terms of quota attainment versus on-target earnings. Outliers may be interesting for finding star performers, poor plan design or errors in calculations (data or logic).

There are many types of analyses that can be performed in relation to sales compensation. Specifically for an audit, it may be particularly useful to have a recurring analysis of results. Variance analysis of payouts — month over month, YTD vs. Prior YTD, and Actual vs. Budget — are a few examples that can quickly tease out widespread issues. For example, we have discovered that a month over month has proven to be the simplest method for finding major issues when many payees had larger variances.

In our experience helping numerous clients, an audit does not always have to be a painful process. You can prepare well in advance by thinking about IC from an audit vantage point. Following a well-documented process is simply a best practice if such efforts can help you avoid turnover, transfers, or loss of motivation within the salesforce (all consequences of a bad sales compensation plan), while at the same time rewarding your company with long-term, monetary results.

Are you prepared for an audit? Keep in mind, you need to consider three essential components: checklists, documentation, and analytics — alongside incentive compensation payouts. Then you will be well on your way to optimal results.

About Ironside

Ironside was founded in 1999 as an enterprise data and analytics solution provider and system integrator. Our clients hire us to acquire, enrich and measure their data so they can make smarter, better decisions about their business. No matter your industry or specific business challenges, Ironside has the experience, perspective and agility to help transform your analytic environment.