With New Tax Laws, Do Your FP&A Modeling Capabilities Set You Up for Success?

The recently passed Tax Cuts and Jobs Act will undoubtedly have broad implications across the corporate landscape as updates to the tax code will necessitate major changes to certain financial management decisions. Finance needs a solid FP&A modeling foundation in order to lead tax-related decision making within their organizations. While there are many aspects of the tax code that will require in-depth financial impact analyses, changes to the deductibility of capital expenditures has been a particular area of interest for some Ironside clients that invest heavily in fixed assets.

Has the New Tax Bill Exposed Any of Your Financial Modeling Capability Gaps?

While the new tax bill contains a number of changes that will impact organizations, one of the major changes is how capital expenditures will be deducted. Beginning in 2018, businesses will be able to immediately deduct the full cost of short lived capital expenditures (such as the purchase of machinery or equipment) up to a maximum of $1 million.

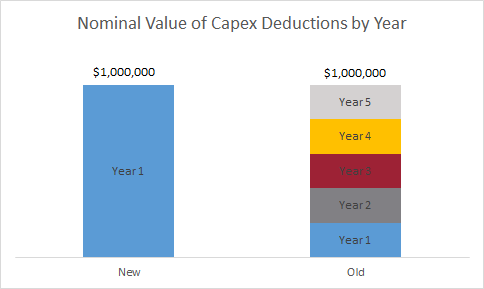

Under pre-2018 tax law, businesses were only able to deduct the amount that a capital asset depreciates, so they realize just a portion of the total expenditure in the form of tax deductions over multiple years. However, the new tax bill completely flips this on its head, as businesses will now be able to immediately deduct the full cost of short-lived capital expenditures up to a maximum of $1 million. While this provision of the tax bill is only valid for the next five years, the tax reduction for companies planning fixed asset investments during this time could be substantial.

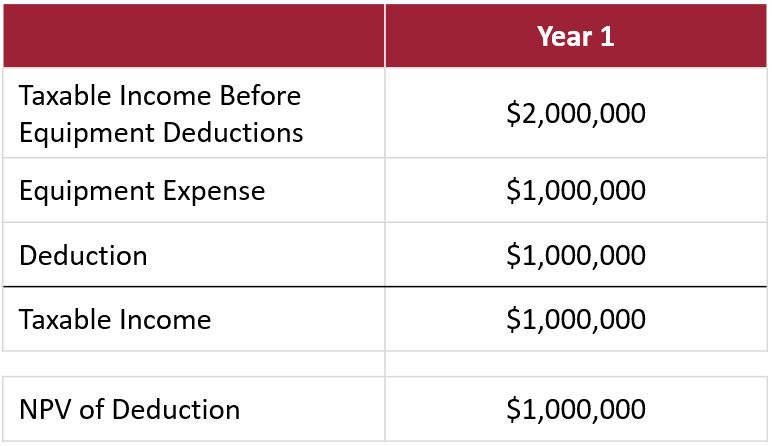

One primary reason is the time value of money. Allowing companies to deduct the full cost immediately, rather than deducting it over the asset’s multi-year useful life, saves them more money by reducing their tax liability by a larger amount in the current year. For example, if a company were to have taxable income of $2 million and purchased capital equipment costing a total of $1 million, they would be able to deduct an additional $1 million from their income for tax purposes, halving their tax liability. If, in turn, it was deducted over 5 years using straight line depreciation, the NPV of the deduction, assuming a 12% cost of capital, would be $721,000.

Table 1 below shows the impact of the deduction if taken over time, while Table 2 shows the impact of the deduction following the passing of the new tax bill.

Table 1

Table 2

In many instances, the above impact analysis is conducted in spreadsheets only as enterprise FP&A solutions often exclude purpose-built modeling that can materially impact financial management decisions. This simplified example is meant to illustrate how the new tax bill has brought this often overlooked and critical capability gap to the forefront for many finance teams.

The New Tax Bill can Help Justify the Need for More Robust FP&A Capabilities

One important quality of a highly effective finance organization is the ability to create transparent and accurate forecasts which lead to better informed financial management decisions. The new Tax Bill has increased pressure on finance organizations to rapidly and accurately map out the impacts that these types of changes will have on their business. This only strengthens the case for implementing a reliable Financial Performance Management strategy that includes a tool with robust taxable income and cash flow forecasting capabilities.

About Ironside

Ironside was founded in 1999 as an enterprise data and analytics solution provider and system integrator. Our clients hire us to acquire, enrich and measure their data so they can make smarter, better decisions about their business. No matter your industry or specific business challenges, Ironside has the experience, perspective and agility to help transform your analytic environment.