Introducing 5 Key Principles for a Modern Office of Finance

From time to time every professional should take a step back and assess where they have been, where they are today and where they want to go. The Office of Finance is no exception. As we begin to plan for next year, we spent some time reflecting on what CFOs and their teams are tasked with. Based on our team’s collective experience in working with the Office of Finance, we have developed what we believe are key principles to succeed going forward.

The Current State: What’s the Point?

We started by defining the current state of the Office of Finance. At a fundamental level, organization financial health and running core operational units are the top two roles. Other responsibilities include:

- Analyzing financial data

- Projecting long-term financial picture

- Generally supporting strategy via financial planning and analysis

We like to call this part of the job “table stakes.” The minimum that needs to be done to keep the lights on…and hopefully a bit more.

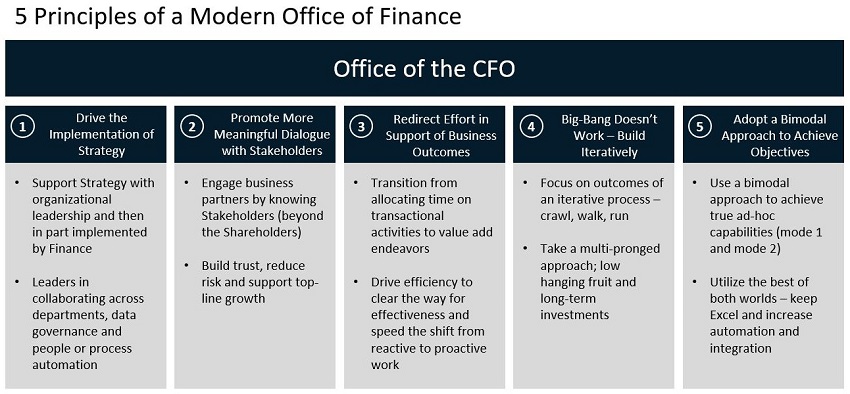

The Five Principles

However, to go further, keeping the lights bright in the organization requires more strategic execution in the Office of Finance. Many have written about the rising importance of the CFO or the evolution of the office of Finance. The Finance team definitely plays a unique role within a company. Some days it’s this, the next day it’s that…

For instance:

- Scorekeeper and goal setter

- Workforce planner and product demand forecaster

- Process designer and process implementer

- Report or analyze the past and predict tomorrow

- Data consumer and data producer

The Office of Finance can definitely be stretched for many needs of the organization. But we see a bright light at the end of the tunnel where finance teams can lead in five key areas.

Simply put, the Five Principles of a Modern Office of Finance will help the organization achieve several benefits.

- Drive the Implementation of Strategy: The budget (or plan) is the financial embodiment of the business strategy. Collaborate to support implementation of strategy utilizing people, process and technology.

- Promote More Meaningful Dialogue with Stakeholders: We feel it is important to become a partner for all departments to build trust and reduce risk.

- Redirect Effort in Support of Business Outcomes: Efficiency clears the way for effectiveness in outcomes. Simply put, integrate and automate to focus on value-add activities (if above/below resonated with them….go above the line).

- Big-bang Doesn’t Work, Build Iteratively: Getting value quickly, while preparing for the long term. We do not follow an all or nothing approach (like an ERP system implementation).

- Adopt a Bimodal Approach to Achieve Objectives: We are not eliminating Excel – it will always be an option, potentially an enhanced option. Variance Analysis is standard view, while ad-hoc capabilities go beyond.

What’s Holding You Back?

Leveraging the five principles can help the Office of Finance drive through common pain points that are holding the organization back. We all face challenges or roadblocks. At the same time, every organization ends up with their unique differences and pain points.

Some of the People, Process, and Technology pain points any organization can encounter at different periods of time are:

- People

- Mindset of “just cutting costs”

- Change management

- Mismatch of resources

- Process

- Inefficient or manual

- Unable to scale for detail, users or manage growth

- Too long to close the books, analyze and provide insight

- Technology

- Inflexible or expensive

- Not user friendly

- Poor user adoption

Instead of just keeping the lights on or limiting what you can achieve, work to break through these limitations.

Manage Growth

Managing growth is a common double-edged sword. Believe it or not, this is a good problem to have, but beware not to spiral out of control and hold back the financial success of the organization. Beyond top-line growth, maximizing profitability and balancing the growth with expenses is key to any effective finance organization. Single digit revenue increases do not balance well with double digit expense increases (with some exceptions).

Sustaining growth while balancing spending requires an analysis of resource allocation to allow the best decisions to be made. Applying the Five Principles supports this balancing act.

Conclusion

Controllers, FP&A teams, and everyone reporting to the CFO permeate throughout an organization. Consider the strategy, partner engagement, and results as you build iteratively and hone your approach. Not only can you keep the lights on, but can you sustain and keep them bright?

Ultimately, Ironside’s Financial Performance Management team strives to help the Office of Finance optimize resources to drive better planning and analysis outcomes that will drive growth. The Five Principles will help get you there. Our next article will dive into the activities that will help you achieve the outcomes outlined by these principles.

This article is an update to 6 Key Principles of a Modern FP&A Function published in March 2018.

About Ironside

Ironside was founded in 1999 as an enterprise data and analytics solution provider and system integrator. Our clients hire us to acquire, enrich and measure their data so they can make smarter, better decisions about their business. No matter your industry or specific business challenges, Ironside has the experience, perspective and agility to help transform your analytic environment.